Smart Investment Strategies for Beginners in 2025

Discover proven investment approaches and portfolio diversification techniques that successful investors use to generate consistent returns...

Your Trusted Financial Partner Pan India

Comprehensive Financial Services including Loans, Taxation, Professional Services, Insurance, IT Solutions, CIBIL Management, Utility Services, and Sarkari Yojana assistance - all under one roof with professional expertise serving customers across India.

Expert assistance to improve your credit score with comprehensive strategies and personalized financial advice. Our professional team helps you understand credit reports, dispute errors, and implement effective credit improvement techniques to achieve better loan approvals and financial health.

Access various sarkari yojana backed business and startup schemes with easy eligibility and competitive interest rates. We provide complete assistance in documentation, application processes, and ensure you get the best terms available under sarkari yojana initiatives and subsidy programs.

Instant Loan, Credit Card, Bank Account Opening, and Mutual Fund services – all available within 24 hours. Our Click & Credit solutions are designed for quick financial empowerment and seamless onboarding, making financial services accessible at the click of a button.

Convenient bill payments, recharges and other utility management services for your ease and comfort. Pay electricity, water, gas, telephone, DTH, mobile recharges, and other essential services through our secure platform. We also provide Utility DMT & AEPS services for enhanced transaction convenience.

Comprehensive professional services including accounting, auditing, taxation and financial advisory by trusted experts. Complete range of services including statutory audits, internal audits, tax planning, company registration, ROC compliance, and comprehensive financial consulting for businesses of all sizes. Our payout services ensure prompt and reliable settlements for all your financial transactions.

Comprehensive IT solutions including software development, consultation and technology integration. Our expert team provides web development, mobile app development, digital marketing, cybersecurity, cloud solutions, and complete IT infrastructure management for businesses.

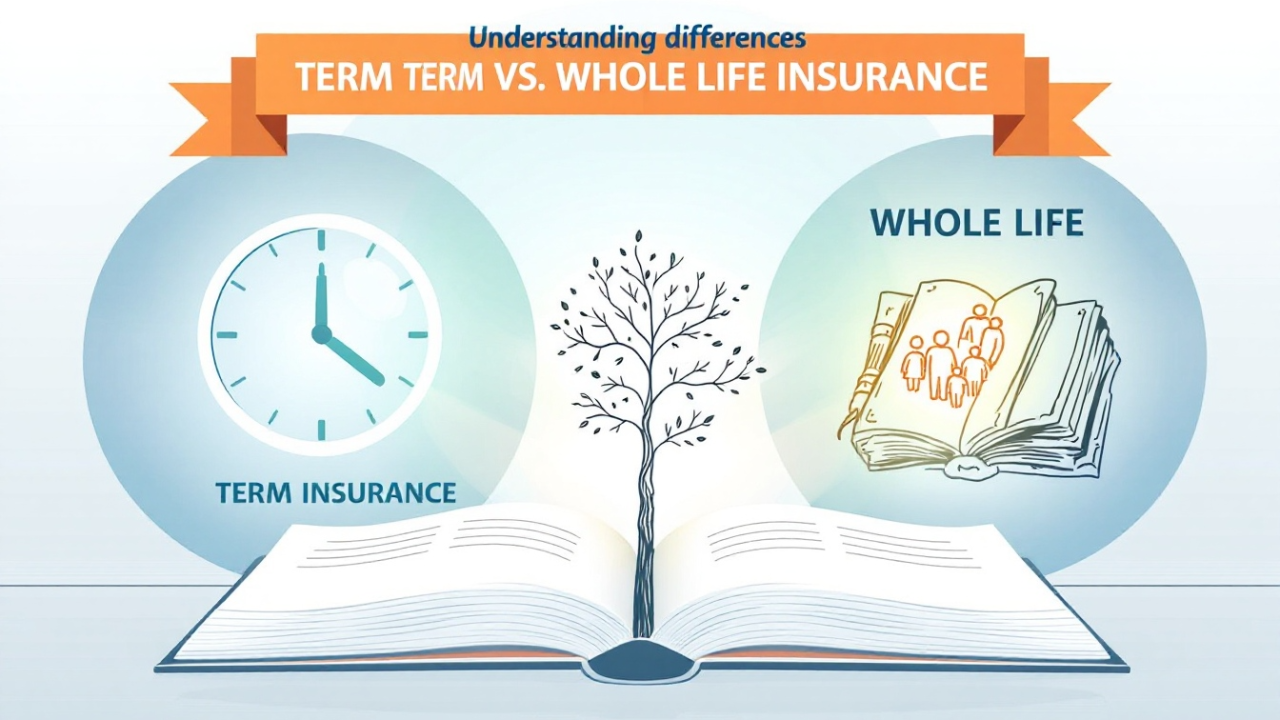

Insurance coverage solutions to protect your health, assets and future with trusted providers. We offer life insurance, health insurance, vehicle insurance, property insurance, travel insurance, and comprehensive business insurance packages with competitive premiums and excellent claim support.

Expert tax consultation, planning and filing services to help optimize your financial obligations. Complete tax solutions including income tax filing, GST registration and returns, TDS services, tax planning strategies, and compliance management for individuals and businesses.

Comprehensive financial solutions tailored to meet all your business and personal needs across India

Complete tax planning, filing, GST registration, and consultation services for individuals and businesses across India.

Comprehensive professional services including accounting, auditing, and financial consulting. Fast payout services ensuring your funds reach you on time.

Instant Loan, Credit Card, Bank Account Opening, Mutual Fund services – Click & Credit within 24 hours for instant financial solutions.

Comprehensive insurance solutions for life, health, property, vehicle, and business protection needs.

Technology solutions, software development, website design, and digital transformation services.

Essential utility services including bill payments, DMT, AEPS, recharge services, and utility management solutions for convenience.

Credit score improvement, CIBIL report analysis, credit management, and loan eligibility enhancement.

Assistance with sarkari yojana schemes, subsidy applications, and mudra yojana financing options.

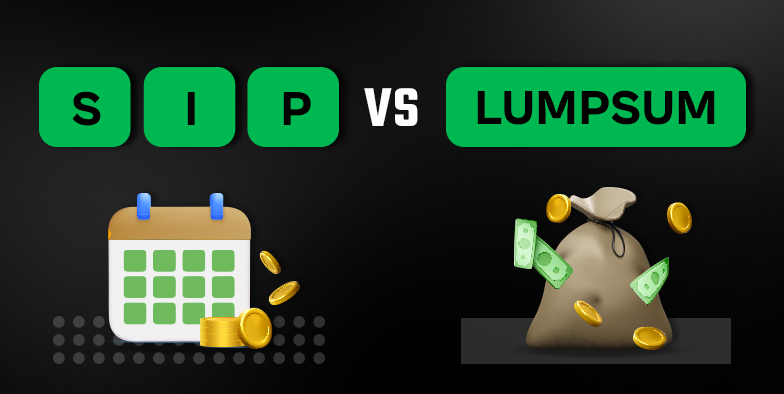

Expert investment guidance, mutual funds, SIP planning, and wealth management solutions.

Experience the difference with our professional approach and commitment to excellence across India

Trusted by thousands of satisfied customers across India for reliable financial solutions and exceptional service quality.

Quick approval processes, minimal documentation, and efficient service delivery to save your valuable time.

Team of experienced financial advisors and industry experts to guide you through complex financial decisions.

Complete transparency in all dealings, secure data handling, and ethical business practices you can trust.

Stay informed with expert analysis, market trends, and practical financial advice

Discover proven investment approaches and portfolio diversification techniques that successful investors use to generate consistent returns...

Comprehensive breakdown of latest GST rule changes, filing deadlines, compliance requirements...

Step-by-step guide to improve your credit score quickly using industry-tested strategies...

Detailed comparison of insurance types, premium structures, coverage benefits...

Comprehensive overview of small business financing options, sarkari yojana schemes...

Data-driven analysis of SIP vs lump sum investments, market timing considerations...

Find answers to the most common questions about our services and processes

We provide all types of loans including personal loans, business loans, home loans etc, education loans, and vehicle loans. Eligibility criteria vary by loan type but generally include age (21-65 years), minimum income requirements, good credit score (650+), and proper documentation. Our experts will help you understand specific eligibility requirements for your chosen loan type.

Our loan approval process typically takes 24-48 hours for pre-approved customers and 3-7 days for new applications. Required documents include identity proof (Aadhar/PAN), address proof, income proof (salary slips/ITR), bank statements for 6 months, and employment/business proof. We also offer digital documentation submission for faster processing.

Yes, we provide free initial consultation for all our services including tax planning, professional services, and financial advisory. Our expert team will analyze your requirements and provide personalized solutions. Detailed consultation and service implementation are charged as per our transparent fee structure.

We use bank-grade security measures including SSL encryption, secure data storage, and strict confidentiality protocols. All client information is protected under data privacy laws, and our team follows stringent security procedures. We never share your personal or financial information with third parties without your explicit consent.

Credorra offers a unique combination of personalized service, expert advisory, and comprehensive solutions under one roof across India. Our experienced team, transparent processes, competitive rates, and commitment to client success set us apart. We focus on building long-term relationships rather than just transactions, ensuring ongoing support for all your financial needs.

Join thousands of satisfied clients who trust Credorra for their comprehensive financial needs. Visit our Dehradun office or get expert consultation today!

Address: 2nd Floor, 15-A, Subhash Road

City: Dehradun-248001, Uttarakhand

Landmark: Near White House Hotel