Life Insurance Solutions

Secure your family's financial future with comprehensive life insurance coverage. Choose from term, whole life, endowment, and ULIP plans designed to provide financial protection and investment benefits.

Understanding Life Insurance

Life insurance is a crucial financial tool that provides financial security to your loved ones in case of an unfortunate event. It ensures that your family's financial goals and daily expenses are taken care of, providing peace of mind and financial stability.

- Financial protection for your family after you

- Tax benefits under Section 80C and 10(10D)

- Wealth creation through investment-linked plans

- Loan facility against policy value

- Maturity benefits for long-term financial goals

- Affordable premiums starting from ₹500/month

- Flexible premium payment options

- Coverage for critical illnesses and disabilities

Types of Life Insurance Policies

Choose from various life insurance plans designed to meet different financial needs, risk appetite, and investment goals. Each type offers unique benefits and features.

Term Life Insurance

Pure protection plan with high coverage at affordable premiums. Best for income replacement and debt protection.

Whole Life Insurance

Lifelong coverage with investment component. Builds cash value while providing permanent protection.

Endowment Plans

Guaranteed maturity benefits with life coverage. Ideal for financial planning and wealth creation.

ULIP Plans

Unit-linked insurance plans combining insurance and investment in equity and debt funds.

Money Back Plans

Periodic payouts during policy term with life coverage. Helps meet intermediate financial needs.

Critical Illness Plans

Coverage for major illnesses like cancer, heart attack, and stroke with lump sum benefits.

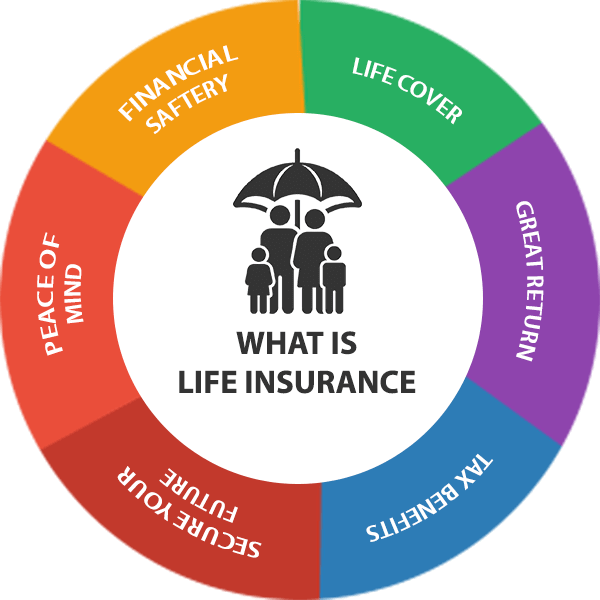

What is Life Insurance?

Life insurance is a contract between you and an insurance company where you pay premiums, and in return, the insurer provides a lump sum payment to your beneficiaries upon your death or policy maturity.

- Financial protection for dependents and family members

- Coverage for outstanding debts and loans

- Education funding for children's future

- Replacement of lost income for family expenses

- Tax-efficient wealth transfer to beneficiaries

- Emergency fund for medical and other expenses

- Retirement planning through investment-linked policies

- Business continuity and key person protection

Whole Life Insurance Benefits

Whole life insurance provides lifelong coverage with guaranteed cash value accumulation. It combines protection and savings, making it an excellent long-term financial planning tool.

- Permanent life insurance coverage until age 100

- Guaranteed cash value growth over time

- Loan facility against accumulated cash value

- Partial withdrawal options available

- Tax-deferred growth on cash value

- Dividend participation in company profits

- Estate planning and wealth transfer benefits

- No medical exam required for renewals

Life Insurance Plan Comparison

Compare different life insurance plans to choose the one that best fits your financial needs and goals.

| Feature | Term Insurance | Whole Life | Endowment | ULIP |

|---|---|---|---|---|

| Premium Cost | Lowest | High | Moderate | Moderate-High |

| Coverage Period | Fixed Term | Lifetime | Fixed Term | Fixed Term |

| Investment Component | No | Yes | Yes | Yes |

| Maturity Benefits | No | Yes | Yes | Yes |

| Flexibility | Low | Medium | Low | High |

Life Insurance Benefits & Tax Advantages

Life insurance offers multiple financial benefits along with significant tax advantages under the Income Tax Act.

Tax Benefits

Premium deduction under Section 80C up to ₹1.5 lakh and tax-free maturity under Section 10(10D).

Wealth Creation

Long-term wealth accumulation through systematic premium payments and compound growth.

Family Security

Financial protection for family members ensuring their lifestyle and future goals are secured.

Child Education

Dedicated plans for children's education with guaranteed payouts for school and college expenses.

Secure Your Family's Future Today

Choose the right life insurance plan for your family's financial security. Get personalized quotes, compare plans, and start your policy with expert guidance from our insurance specialists.

Get Life Insurance Quote