Saving for Child Insurance

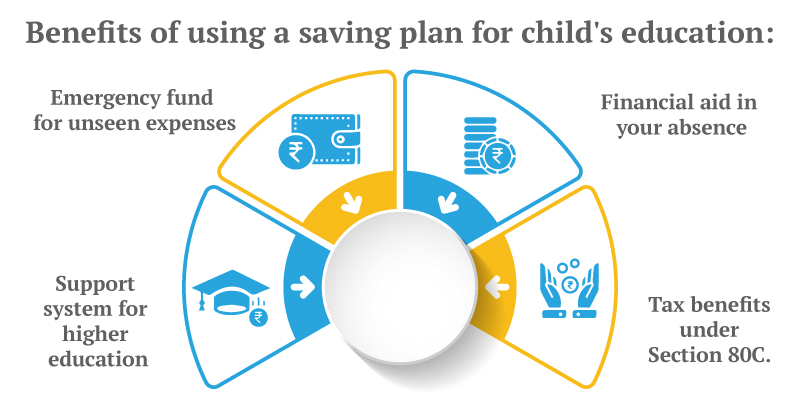

Secure your child's future with comprehensive savings and insurance plans. Build a strong financial foundation for education, career, and life goals with guaranteed returns and flexible investment options.

Why Save for Your Child's Future?

Child insurance plans combine savings and protection to secure your child's financial future. These plans provide guaranteed returns, life coverage, and flexibility to meet education expenses, career goals, and major life events.

- Guaranteed maturity benefits for education and career funding

- Life insurance coverage for financial protection

- Tax benefits under Section 80C and 10(10D)

- Flexible premium payment options and tenure

- Waiver of premium in case of parent's demise

- Additional riders for critical illness and disability

- Long-term wealth creation through systematic savings

- Inflation-adjusted returns to maintain purchasing power

Child's Education Planning

Education costs are rising rapidly, making early planning essential. Child education plans ensure your child gets quality education without financial constraints, covering school fees, college expenses, and higher education abroad.

School Education

Secure funding for quality schooling, extracurricular activities, and skill development programs.

College & University

Comprehensive coverage for undergraduate and postgraduate education expenses.

Study Abroad

High corpus building for international education and living expenses overseas.

Professional Courses

Funding for specialized courses, certifications, and skill development programs.

Education Investment Goals

Setting clear investment goals helps build adequate corpus for your child's education. Calculate future education costs, inflation impact, and required monthly investments to achieve financial targets.

| Education Level | Current Cost (₹) | Cost After 15 Years (₹) | Monthly SIP Required (₹) |

|---|---|---|---|

| School Education | 2-5 Lakhs | 6-15 Lakhs | 3,000-7,500 |

| Engineering/Medical | 10-20 Lakhs | 30-60 Lakhs | 15,000-30,000 |

| MBA/Professional | 15-25 Lakhs | 45-75 Lakhs | 22,500-37,500 |

| Study Abroad | 25-50 Lakhs | 75-150 Lakhs | 37,500-75,000 |

Savings Insurance Plans

Savings insurance plans offer dual benefits of life coverage and wealth creation. These plans provide guaranteed returns with life insurance protection, making them ideal for long-term financial planning.

- Guaranteed maturity benefits with life insurance coverage

- Premium waiver benefit in case of parent's death

- Tax benefits on premiums paid and maturity proceeds

- Flexible premium payment options - annual, half-yearly, monthly

- Additional riders for enhanced protection

- Loan facility against policy value after 3 years

- Survival benefits during policy term

- Bonus additions for enhanced returns

Best Savings Plans for Children

Choose from various savings plans designed specifically for children's financial needs. Each plan offers unique benefits and features to match different investment goals and risk appetites.

Child Endowment Plans

Guaranteed returns with life coverage, ideal for conservative investors seeking security.

Child ULIP Plans

Market-linked returns with insurance coverage for higher growth potential.

Money Back Plans

Periodic payouts during policy term for meeting intermediate financial needs.

Whole Life Plans

Lifelong coverage with cash value accumulation for comprehensive protection.

PPF for Children

Tax-free savings with 15-year lock-in period for long-term wealth creation.

Sukanya Samriddhi

Government scheme for girl child with attractive interest rates and tax benefits.

Smart Planning Tips

Follow these expert tips to make the most of your child insurance and savings plans for optimal results.

- Start early to leverage the power of compounding

- Calculate future education costs considering inflation

- Diversify investments across different plan types

- Review and adjust plans periodically based on goals

- Consider premium waiver benefit for added security

- Choose flexible plans that allow partial withdrawals

- Maximize tax benefits under various sections

- Keep beneficiary nominations updated

Secure Your Child's Future Today

Start building a strong financial foundation for your child's dreams and aspirations. Get expert guidance on the best savings and insurance plans tailored to your family's needs and goals.

Get Child Insurance Quote