General Insurance Solutions

Comprehensive protection for all your assets, health, and business needs. Choose from a wide range of general insurance policies offering complete financial security and peace of mind.

What is General Insurance?

General insurance provides financial protection against unforeseen events and losses for non-life assets. It covers property, vehicles, health, travel, and business risks, ensuring financial security when you need it most.

- Protection against financial losses from accidents and damage

- Coverage for property, vehicles, health, and personal belongings

- Legal compliance for mandatory insurance requirements

- Peace of mind with comprehensive risk management

- Cashless claim settlements and quick processing

- 24/7 customer support and emergency assistance

- Flexible premium payment options and tenure

- Tax benefits under various sections of Income Tax Act

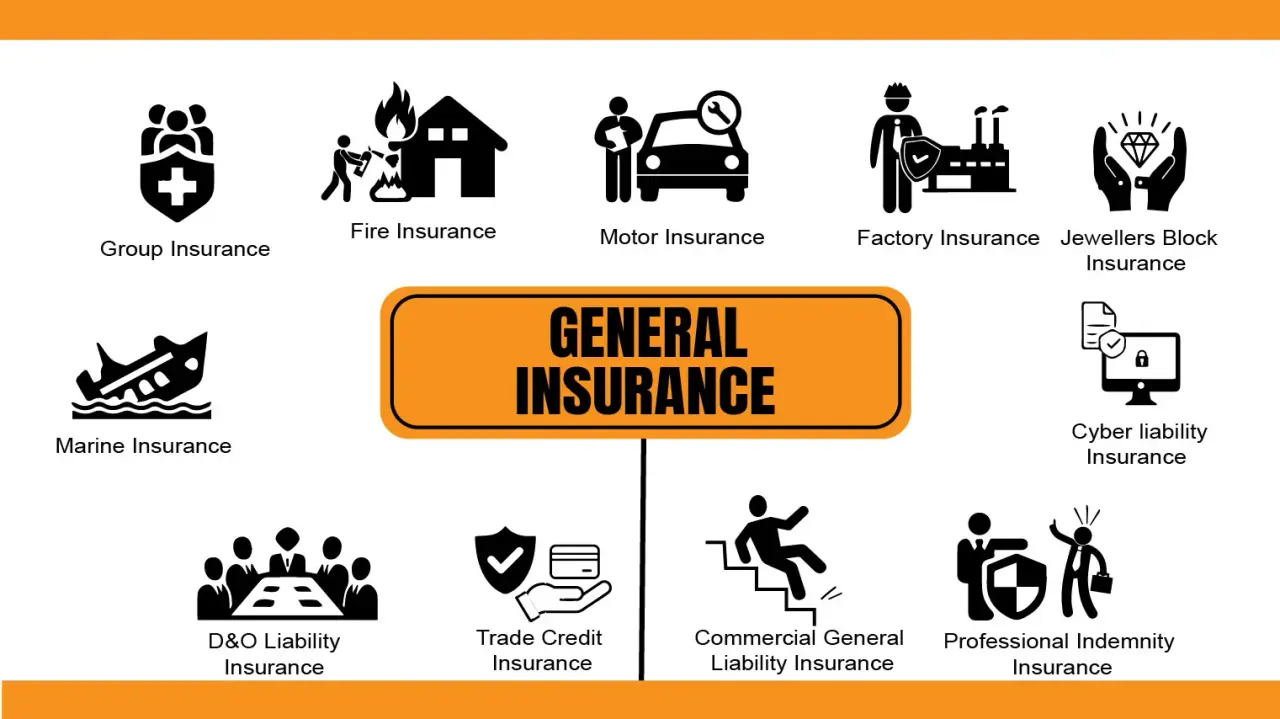

Types of General Insurance

General insurance offers diverse coverage options to protect different aspects of your life and business. Each type is designed to address specific risks and requirements.

Motor Insurance

Comprehensive protection for cars, bikes, and commercial vehicles with third-party liability and own damage coverage.

Health Insurance

Medical coverage for individuals and families including hospitalization, critical illness, and preventive care.

Property Insurance

Protection for residential and commercial properties against fire, theft, natural disasters, and damage.

Travel Insurance

Coverage for domestic and international travel including medical emergencies, trip cancellation, and baggage loss.

Personal Accident

Financial protection against accidental death, disability, and medical expenses due to accidents.

Business Insurance

Comprehensive coverage for business operations, liability, equipment, and professional indemnity.

General Insurance Policy Comparison

Compare different general insurance policies to understand coverage options and choose the best protection for your needs.

| Insurance Type | Coverage Duration | Premium Range | Key Benefits |

|---|---|---|---|

| Motor Insurance | 1 Year | ₹2,000-₹15,000 | Third-party + Own damage |

| Health Insurance | 1-3 Years | ₹5,000-₹25,000 | Hospitalization + OPD |

| Home Insurance | 1 Year | ₹3,000-₹20,000 | Fire + Theft + Natural disasters |

| Travel Insurance | Trip Duration | ₹500-₹5,000 | Medical + Baggage + Trip delay |

| Personal Accident | 1 Year | ₹200-₹2,000 | Death + Disability benefits |

Key Benefits of General Insurance

General insurance provides comprehensive financial protection and various benefits to secure your assets and family's future.

- Financial protection against unexpected losses and damages

- Legal compliance with mandatory insurance requirements

- Cashless claim settlements at network providers

- 24/7 customer support and emergency assistance

- Tax benefits and deductions under Income Tax Act

- Flexible premium payment options and tenure

- Add-on covers for enhanced protection

- No-claim bonus for claim-free policy periods

- Wide network of hospitals, garages, and service providers

- Digital policy management and instant renewals

Get Your General Insurance Quote Today

Protect yourself, your family, and your assets with comprehensive general insurance coverage. Compare policies, get instant quotes, and choose the best protection plan with expert guidance.

Get Insurance Quote