Pension & Retirement Insurance Solutions

Secure your retirement with trusted pension plans and retirement insurance. Enjoy financial independence, predictable income, and peace of mind for your golden years.

Why Choose Pension & Retirement Insurance?

Pension and retirement insurance help you accumulate a retirement corpus, ensuring steady income post-retirement. These plans offer financial security, tax benefits, and flexible options tailored to your needs.

- Guaranteed stream of income after retirement

- Tax benefits under Section 80CCC and 80CCD

- Customizable payout options and terms

- Protection against inflation risks

- Option to add family members as beneficiaries

- Systematic investment and savings growth

Types of Pension & Retirement Plans

Explore various pension and retirement planning options offered by insurers, including government-backed and private schemes focused on wealth accumulation and retirement income security.

Government Pension Plans

Public pension schemes providing assured returns and social security benefits.

Corporate Retirement Plans

Employer-sponsored retirement benefits with contribution matching and investment options.

Annuity Plans

Financial products guaranteeing fixed periodic income post retirement.

Unit Linked Pension Plans

Investment-linked plans offering growth potential with insurance cover.

Tips for Successful Retirement Planning

Effective retirement planning requires early action and informed decisions. Consider these tips to build a robust retirement corpus and enjoy financial freedom during your retirement years.

- Start saving early for greater corpus accumulation

- Diversify investments across pension schemes

- Understand tax implications and optimize benefits

- Regularly review and adjust retirement plans

- Account for inflation and health care costs

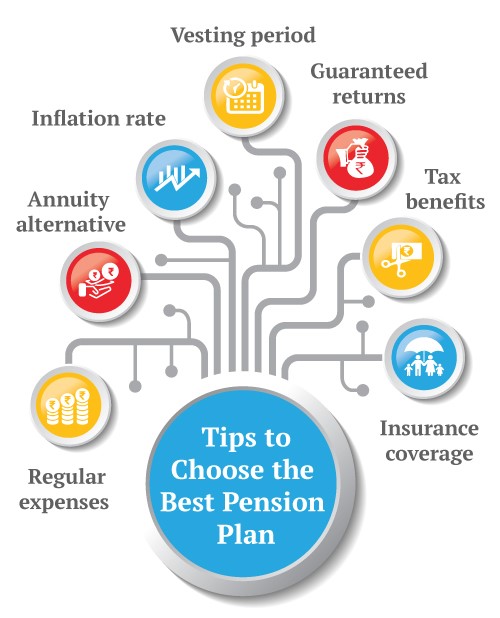

How to Choose the Best Pension Plan

Selecting the right pension plan depends on your retirement goals, risk tolerance, and investment horizon. Evaluate features like payout options, fund performance, and flexibility to make an informed choice.

- Consider your anticipated retirement lifestyle and needs

- Check fund performance and financial strength of insurer

- Assess flexibility of premium payments and withdrawals

- Compare options with tax benefits and riders

- Seek professional advice to tailor the plan

Secure Your Retirement Today

Get personalized pension and retirement insurance plans designed to match your financial goals and ensure your peace of mind in your golden years.

Get Pension Plan Quote